Reconnect with Gone-away Members. Calculate Liabilities with Confidence.

What You Can Do

with HEKA

Global Tracing

and Data Restoration

What You Usually See

A partial internal file — incomplete name, outdated address, missing contact information.

Web Signal Ingestion

Heka searches beyond credit files, pulling behavioural, relational, and digital presence data — including name variations, social traces, and network analysis.

AI Structuring and Resolution

Signals are matched, filtered, and scored for confidence. Contradictions are flagged. Deceased profiles are confirmed. Matches are explained.

Restored Member Record

You get a verified outcome:

- Verified contact details (phone, email, postal)

- Marital status + spousal data (name, age, contact)

- Mortality confirmation (where applicable)

Actionable, Traceable Output

Card Stack paragraph

Powered by

Heka’s Identity Intelligence Engine

sources

Explore More Resources

Button Text

Retirement Without Borders: Navigating the Global Migration Trend and its Impact on UK Pension Schemes

The New Retirement Reality

The "traditional" UK retiree is a vanishing demographic. As of 2026, the Office for National Statistics (ONS) and the DWP report that over 1.1 million UK pensioners now reside overseas. This isn't just a trend for high-net-worth individuals; it is a cross-demographic shift driven by global mobility and the search for lower costs of living.

However, the risk to pension schemes doesn't start at the point of retirement. It begins decades earlier.

The Rising Challenge of the Mobile Workforce

While pensioners moving abroad is a well-documented trend, a more systemic risk is quietly accumulating in the "deferred" category: The Young Mobile Workforce.

- The 75% Stat: Recent data reveals that 75% of UK emigrants are now under the age of 35. These are young professionals moving for global career opportunities.

- The "Digital Decay" of Small Pots: These individuals leave behind small, auto-enrolled pension pots. Within a few years of moving, their UK digital footprint (electoral roll, credit headers) begins to decay, making them "untraceable" by standard domestic methods.

- Fragmented Careers: By the time these workers reach retirement, they may have accrued numerous different pots. The administrative cost of managing these "lost" small pots – currently valued at a total of £31.1 billion in the UK – is a significant drain on scheme resources.

Three Growing Risks for Trustees

1. The Fiduciary "Out of Touch" Trap

A trustee’s duty of care does not end when a member moves overseas. Traditional UK-centric tracing is no longer a "reasonable endeavor" when a significant portion of the membership is international. Without global data, trustees cannot fulfill mandated disclosure requirements or support members in making informed retirement choices.

2. The Mortality Blindspot

The most significant financial risk is overpayment. Without robust international mortality screening, schemes can continue paying benefits for years after a member has passed away overseas. Reclaiming these funds from foreign jurisdictions is legally complex and often impossible.

3. Member Welfare & Social Responsibility

Small pots represent a member's future livelihood. When schemes lose touch, they lose the ability to provide value. For the mobile workforce, being "out of touch" means being "under-saved."

Closing the Gap: Next-Generation Data Restoration

To address these complexities, the industry is moving toward AI-enabled web intelligence that looks beyond standard registry searches. Heka’s approach focuses on three core pillars to restore scheme integrity:

- Global Web Intelligence: By scanning over 3,000 data sources across the open-source web, schemes can locate members deemed "untraceable" by standard legacy providers. This includes identifying active digital footprints such as verified mobiles, professional profiles, and even local news stories to verify identity and marital status.

- Dynamic Mortality & Life Status: AI can detect "unreported" life events by identifying signals like online obituaries or funeral recordings globally. This allows for real-time mortality updates even in jurisdictions where official death registries are slow or inaccessible.

- Next-of-Kin & Relationship Mapping: Modern family structures are complex. Data enrichment can now identify spouses, children, and next-of-kin through relational mapping, ensuring that death benefits reach the correct beneficiaries and helping to re-establish contact with the primary member.

Conclusion

As the UK workforce becomes more international, the risk of "lost" members is no longer a fringe issue – it is a core governance challenge. Trustees who bridge the global data gap today will protect their members’ welfare and their scheme’s long-term financial health.

The New Faces of Fraud: How AI Is Redefining Identity, Behavior, and Digital Risk

1. Introduction – Identity Is No Longer a Fixed Attribute

The biggest shift in fraud today isn’t the sophistication of attackers – it’s the way identity itself has changed.

AI has blurred the boundaries between real and fake. Identities can now be assembled, morphed, or automated using the same technologies that power legitimate digital experiences. Fraudsters don’t need to steal an identity anymore; they can manufacture one. They don’t guess passwords manually; they automate the behavioral patterns of real users. They operate across borders, devices, and platforms with no meaningful friction.

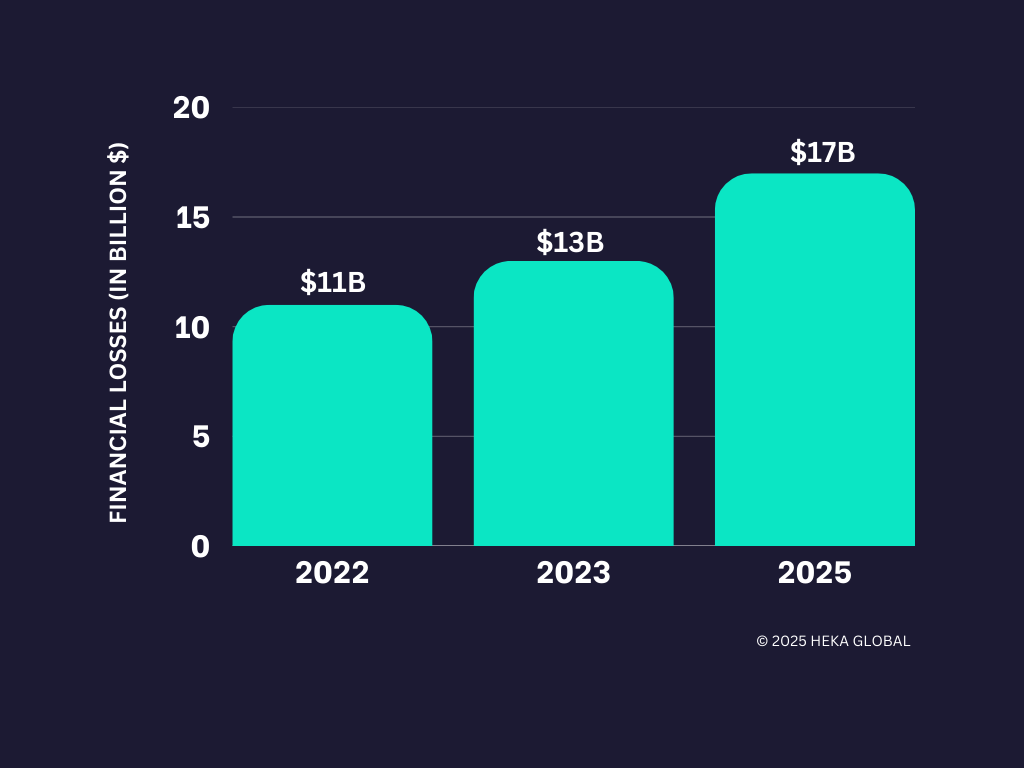

The scale of the problem continues to accelerate. According to the Deloitte Center for Financial Services, synthetic identity fraud is expected to reach US $23 billion in losses by 2030. Meanwhile, account takeover (ATO) activity has risen by nearly 32% since 2021, with an estimated 77 million people affected, according to Security.org. These trends reflect not only rising attack volume, but the widening gap between how identity operates today and how legacy systems attempt to secure it.

This isn’t just “more fraud.” It’s a fundamental reconfiguration of what identity means in digital finance – and how easily it can be manipulated. Synthetic profiles that behave like real customers, account takeovers that mimic human activity, and dormant accounts exploited at scale are no longer anomalies. They are a logical outcome of this new system.

The challenge for banks, neobanks, and fintechs is no longer verifying who someone is, but understanding how digital entities behave over time and across the open web.

2. The Blind Spots in Modern Fraud Prevention

Most fraud stacks were built for a world where:

- identity was stable

- behavior was predictable

- fraud required human effort

Today’s adversaries exploit the gaps in that outdated model.

Blind Spot 1 — Static Identity Verification

Traditional KYC treats identity as fixed. Synthetic profiles exploit this entirely by presenting clean credit files, plausible documents, and AI-generated faces that pass onboarding without friction.

Blind Spot 2 — Device and Channel Intelligence

Legacy device fingerprinting and IP checks no longer differentiate bots from humans. AI agents now mimic device signatures, geolocation drift, and even natural session friction.

Blind Spot 3 — Transaction-Centric Rules

Fraud rarely begins with a transaction anymore. Synthetics age accounts for months, ATO attackers update contact information silently, and dormant accounts remain inactive until the moment they’re exploited.

In short: fraud has become dynamic; most defenses remain static.

3. The Changing Nature of Digital Identity

For decades, digital identity was treated as a stable set of attributes: a name, a date of birth, an address, and a document. The financial system – and most fraud controls – were built around this premise. But digital identity in 2025 behaves very differently from the identities these systems were designed to protect.

Identity today is expressed through patterns of activity, not static attributes. Consumers interact across dozens of platforms, maintain multiple email addresses, replace devices frequently, and leave fragmented traces across the open web. None of this is inherently suspicious – it’s simply the consequence of modern digital life.

The challenge is that fraudsters now operate inside these same patterns.

A synthetic identity can resemble a thin-file customer.

An ATO attacker can look like a user switching devices.

A dormant account can appear indistinguishable from legitimate inactivity.

In other words, the difficulty is not that fraudsters hide outside normal behavior – it is that the behavior considered “normal” has expanded so dramatically that older models no longer capture its boundaries.

This disconnect between how modern identity behaves and how traditional systems verify it is precisely what makes certain attack vectors so effective today. Synthetic identities, account takeovers, and dormant-account exploitation thrive not because they are new techniques, but because they operate within the fluid, multi-channel reality of contemporary digital identity – where behavior shifts quickly, signals are fragmented, and legacy controls cannot keep pace.

4. Synthetic IDs: Fraud With No Victim and No Footprint

Synthetic identities combine real data fragments with fabricated details to create a customer no institution can validate – because no real person is missing. This gives attackers long periods of undetected activity to build credibility.

Fraudsters use synthetics to:

- open accounts and credit lines,

- build transaction history,

- establish low-risk behavioral patterns,

- execute high-value bust-outs that are difficult to recover.

Why synthetics succeed

- Thin-file customers look similar to fabricated identities.

- AI-generated faces and documents bypass superficial verification.

- Onboarding flows optimized for user experience leave less room for deep checks.

- Synthetic identities “warm up” gradually, behaving consistently for months.

Equifax estimates synthetics now account for 50–70% of credit fraud losses among U.S. banks.

What institutions must modernize

One-time verification cannot identify a profile that was never tied to a real human. Institutions need ongoing, external intelligence that answers a different question:

Does this identity behave like an actual person across the real web?

5. Account Takeover: When Verified Identity Becomes the Attack Surface

Account takeover (ATO) is particularly difficult because it begins with a legitimate user and legitimate credentials. Financial losses tied to ATO continue to grow. VPNRanks reports a sustained increase in both direct financial impact and the volume of compromised accounts, further reflecting how identity-based attacks have become central to modern fraud.

Fraudsters increasingly use AI to automate:

- credential-stuffing attempts,

- session replay and friction simulation,

- device and browser mimicry,

- navigation patterns that resemble human users.

Once inside, attackers move quickly to secure control:

- updating email addresses and phone numbers,

- adding new devices,

- temporarily disabling MFA,

- initiating transfers or withdrawals.

Signals that matter today

Early indicators are subtle and often scattered:

- Email change + new device within a short window

- Logins from IP ranges linked to synthetic identity clusters

- High-velocity credential attempts preceding a legitimate login

- Sudden extensions of the user’s online footprint

- Contact detail changes followed by credential resets

The issue is not verifying credentials; it is determining whether the behavior matches the real user.

6. Dormant Accounts: The Silent Fraud Vector

Dormant or inactive accounts, once considered low-risk, have become reliable targets for fraud. Their inactivity provides long periods of concealment, and they often receive less scrutiny than active accounts. This makes them attractive staging grounds for synthetic identities, mule activity, and small-value laundering that can later escalate.

Fraudsters use dormant accounts because they represent the perfect blend of low visibility and high permission: the infrastructure of a legitimate customer without the scrutiny of an active one.

Why dormant ≠ low-risk

Dormant accounts are vulnerable because of their inactivity – not in spite of it.

- They bypass many ongoing monitoring rules.

Most systems deprioritize accounts with no transactional activity. - Attackers can prepare without triggering alerts.

Inactivity hides credential testing, information gathering, and initial contact-detail changes. - Reactivation flows are often weaker than onboarding flows.

Institutions assume returning customers are inherently trustworthy. - Contact updates rarely raise suspicion.

A fraudster changing an email or phone number on a dormant account is often treated as routine. - Fraud can accumulate undetected for long periods.

Months or years of dormancy create a wide window for planning, staging, and lateral movement.

Better defenses

Institutions benefit from:

- refreshing identity lineage at the moment of reactivation,

- updating digital-footprint context rather than relying on historical data,

- linking dormant accounts to known synthetic or mule clusters.

Dormant ≠ safe. Dormant = unobserved.

7. How Modern Fraud Actually Operates (AI + Lifecycle)

Fraud today is not opportunistic. It is operational, coordinated, and increasingly automated.

How AI amplifies fraud operations

AI enables fraudsters to automate tasks that were once slow or manual:

- Identity creation: synthetic faces, forged documents, fabricated businesses

- Scalable onboarding: bots submitting high volumes of applications

- Behavioral mimicry: friction simulation, geolocation drift, session replay

- Customer-support evasion: LLM agents bypassing KBA or manipulating staff

- OSINT mining: automated scraping of breached data and persona fragments

This automation feeds into a consistent operational lifecycle.

The modern fraud lifecycle

- Identity Fabrication

AI assembles identity components designed to pass onboarding. - Frictionless Onboarding

Attackers target institutions with low-friction digital processes. - Seasoning or Dormancy

Accounts age quietly, building legitimacy or remaining inactive. - Account Manipulation

Email, phone, and device updates prepare the account for monetization. - Monetization & Disappearance

Funds move quickly – often across jurisdictions – before detection.

Most institutions detect fraud in Stage 5. Modern prevention requires detecting divergence in Stages 1–4.

8. Rethinking Defense: From Static Checks to Continuous Intelligence

Fraud has evolved from discrete events to continuous identity manipulation. Defenses must do the same. This shift is fundamental:

Institutions must understand identity the way attackers exploit it – as something dynamic, contextual, and shaped by behavior over time.

9. Conclusion

Fraud is becoming faster, more coordinated, and scaling at levels never seen before. Institutions that adapt will be those that begin viewing it as a continuously evolving system.

Those that win the next phase of this battle will stop relying on static checks and begin treating identity as something contextual and continuously evolving.

That requires intelligence that looks beyond internal systems and into the open web, where digital footprints, behavioral signals, and online history reveal whether an identity behaves like a real person, or a synthetic construct designed to exploit the gaps.

At Heka Global, our platform delivers real-time, explainable intelligence from thousands of global data sources to help fraud teams spot non-human patterns, identity inconsistencies, and early lifecycle divergence long before losses occur.

In an AI-versus-AI world, timing is everything. The earlier your system understands an identity, the sooner you can stop the threat.

.png)

A Letter to the Editor: The Observer

The Observer (tag the observer account) published a piece back in March on the dire state of member data in the Teachers’ Pension Scheme- an all-too-familiar issue across the UK pensions landscape. I submitted a letter in response. It wasn’t published, but the point still stands- and is arguably more urgent now than ever. So I’m sharing it here.

The technology exists. The tools exist. What’s missing is the urgency.

It’s 2025- accurate data should be the baseline, not the exception.

Read the original article on the Guardian.

Heka Raises $14M to bring Real-Time Identity Intelligence to Financial Institutions

FOR IMMEDIATE RELEASE

Heka Raises $14M to bring Real-Time Identity Intelligence to Financial Institutions

Windare Ventures, Barclays and other institutional investors back Heka’s AI engine as financial institutions seek stronger defenses against synthetic fraud and identity manipulation.

New York, 15 July 2025

Consumer fraud is at an all-time high. Last year, losses hit $12.5 billion – a 38% jump year-over-year. The rise is fueled by burner behavior, synthetic profiles, and AI-generated content. But the tools meant to stop it – from credit bureau data to velocity models – miss what’s happening online. Heka was built to close that gap.

Inspired by the tradecraft of the intelligence community, Heka analyzes how a person actually behaves and appears across the open web. Its proprietary AI engine assembles digital profiles that surface alias use, reputational exposure, and behavioral anomalies. This helps financial institutions detect synthetic activity, connect with real customers, and act faster with confidence.

At the core of Heka’s web intelligence engine is an analyst-grade AI agent. Unlike legacy tools that rely on static files, scores, or blacklists, Heka’s AI processes large volumes of web data to produce structured outputs like fraud indicators, updated contact details, and contextual risk signals. In one recent deployment with a global payment processor, Heka’s AI engine caught 65% of account takeover losses without disrupting healthy user activity.

Heka is already generating millions in revenue through partnerships with banks, payment processors, and pension funds. Clients use Heka’s intelligence to support critical decisions from fraud mitigation to account management and recovery. The $14 million Series A round, led by Windare Ventures with participation by Barclays, Cornèr Banca, and other institutional investors, will accelerate Heka’s U.S. expansion and deepen its footprint across the UK and Europe.

“Heka’s offering stood out for its ability to address a critical need in financial services – helping institutions make faster, smarter decisions using trustworthy external data. We’re proud to support their continued growth as they scale in the U.S.” said Kester Keating, Head of US Principal Investments at Barclays.

Ori Ashkenazi, Managing Partner at Windare Ventures, added: “Identity isn’t a fixed file anymore. It’s a stream of behavior. Heka does what most AI can’t: it actually works in the wild, delivering signals banks can use seamlessly in workflows.”

Heka was founded by Rafael Berber, former Global Head of Equity Trading at Merrill Lynch; Ishay Horowitz, a senior officer in the Israeli intelligence community; and Idan Bar-Dov, a fintech and high-tech lawyer. The broader team includes intel analysts, data scientists, and domain experts in fraud, credit, and compliance.

“The credit bureaus were built for another era. Today, both consumers and risk live online. Heka’s mission is to be the default source of truth for this new digital reality – always-on, accurate, and explainable.” said Idan Bar-Dov, the Co-founder and CEO of Heka.

About Heka

Heka delivers web intelligence to financial services. Its AI engine is used by banks, payment processors, and pension funds to fill critical blind spots in fraud mitigation, credit-decision, and account recovery. The company was founded in 2021 and is headquartered in New York and Tel Aviv.

Press contact

Joy Phua Katsovich, VP Marketing | joy@hekaglobal.com

.png)

ZEDRA and Heka Join Forces to Trace Missing Pension Members with AI

We’re proud to announce our partnership with ZEDRA Governance to help pension schemes tackle one of the sector’s biggest challenges: tracing missing members.

Following a successful pilot where Heka’s AI-powered tracing identified 50% of previously unreachable members, ZEDRA will now offer our technology to clients via a dedicated architecture, bringing scale and speed to both small and large schemes.

“Reuniting members with their full retirement benefits is a core fiduciary duty,” said Mark Stopard, Head of Proposition Development at ZEDRA Governance. “We’re excited to see the results of this initiative as part of our commitment to helping clients solve the issue of lost pensions.”

Heka's technology helps schemes locate current contact details, life status, and digital signals even when records are outdated or fragmented. By partnering with ZEDRA, we’re enabling better member engagement, reduced risk, and readiness for future reforms.

“Many of the toughest challenges in the pensions sector start with missing data,” said Max Lack, Business Development Manager at Heka. “Solving that unlocks everything else- from dashboard readiness to retirement adequacy.”

Read the full announcement on ZEDRA’s website.